First published on Friday, March 28, 2025

Last updated on Friday, March 28, 2025

If you run a small business, you’re probably already bracing yourself for the latest UK minimum wage increase. From April 1st, 2025, the National Living and Minimum Wage is set to rise, which is great news for your staff but might have you nervously eyeing your payroll.

Let’s break it down—minus any headaches.

What’s changing?

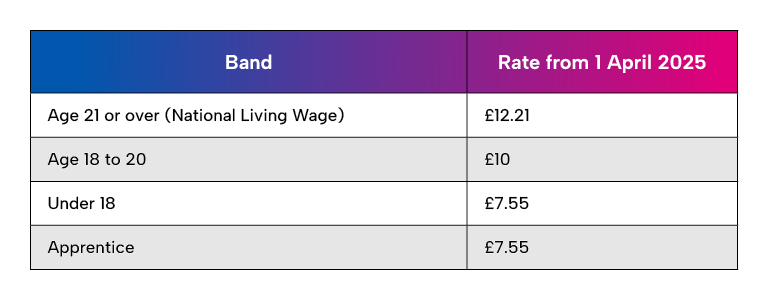

The National Living Wage (for those over 21) and the National Minimum Wage (for those of at least school leaving age) are both going up.

Here’s the headline stat: the National Living Wage will rise to £12.21 per hour from £11.44. That’s a jump of 6.7% from last year.

For small business owners, particularly those in retail, hospitality, and other labour-intensive sectors, this means one thing—your weekly rota costs are about to go up.

The impact on your weekly rota

You don’t need an economics degree to know that when wages rise, your wage bill does too.

Let’s say you employ a few full-time staff over the age of 21 on minimum wage, working 35-hour weeks. Last year, each employee cost you roughly £400 per week. This year? That same employee will cost you around £427 per week.

Multiply that across a handful of staff, and suddenly your monthly payroll has ballooned.

Even if you rely on part-time staff, you’ll still feel the pinch. Even someone working a 20-hour week will cost you an extra £15.40 per week—it all adds up.

What can you do?

Before you start panicking or cutting shifts, here are some practical ways to absorb the increase:

Review your rota efficiently

Look at your staffing levels—are there peak and quiet times that could be better managed? It might be time to rethink shift patterns or consider cross-training staff so fewer people can cover more roles.

Adjust prices, (carefully!)

Passing the cost onto customers is tricky, but small price tweaks can help balance the books. A 10p increase on a coffee or a small bump in service prices might make a bigger difference than you think.

Consider alternative staffing options

Think about flexible working arrangements, seasonal hires, or even apprenticeships. Some businesses benefit from hiring under-18s, whose minimum wage rates are lower, though this depends on your industry, and you need to be careful.

Prioritising younger employees with additional paid hours may lead to potential breaches of the Equality Act 2010 and put your business at risk of age discrimination.

Instead, focus on enhancing team productivity and promptly addressing any performance issues.

Boost productivity

If you’re paying more per hour, make those hours work harder. Are there tasks that could be streamlined? Can technology help?

Even simple changes—like switching to a more efficient HR solution—can free up time and increase efficiency.

Utilise HR and payroll software

Managing wage increases manually can be a real headache. HR and payroll software can automate wage calculations, flag scheduling inefficiencies, and even suggest cost-saving adjustments.

Many tools also help track employee hours more accurately, ensuring you’re only paying for time actually worked. So if you haven’t already invested in payroll software, now may just be the perfect time.

The bright side of the wage increase

It’s easy to see wage increases as just another cost, but there are upsides. Happier employees tend to stick around, meaning lower turnover and recruitment costs.

Yes, the wage increase is an extra challenge, but with a bit of planning and creativity, you can manage it without sending your weekly rota into a tailspin.

And, if you’d prefer for us to handle it all for you—register your interest in our fully managed payroll service solution, coming soon!