First published on Thursday, July 18, 2024

Last updated on Thursday, March 27, 2025

Jump to section

As a small business owner, you have a thousand things on your plate not just payroll. If these aspects of running a business are becoming overwhelming, it may be time to explore payroll solutions.

But when is the right time to consider a payroll solution? At the crossroads of growth, complexity, and error management is where the answer lies.

Let’s walk you through identifying when a payroll system becomes a necessity and how it can facilitate your business’s growth and success.

Identifying the right moment for payroll automation

You’ve been running your small business smoothly, but as you expand, the payroll tasks start piling up. As a result, manual payroll management becomes a time-consuming and error-prone process.

The more you grow, the more you realise that you’re spending an increasing amount of time on payroll, and the number of errors is beginning to rise. You realise that managing payroll manually is no longer sustainable.

You also find that staying compliant with HMRC regulations and submitting reports on time is becoming more complex. You begin to wonder whether there’s a better way to handle payroll.

The answer is a resounding ‘yes’! The signs are clear—it’s time to transition to a comprehensive payroll solution.

Business growth and employee numbers

Growing your business is a thrilling journey, but it comes with its set of challenges. One of these is the increase in payroll tasks. With every new team member you hire, the demands on your payroll grow.

On average it takes small businesses a total of 1-3 days to complete the payroll cycle. As your business grows this can even take up to one whole working week. A week of your time gone on payroll management alone. It seems impractical and certainly not the most effective use of your time.

By automating your payroll processes with the likes of a payroll software, you can significantly reduce the manual effort involved in managing payroll for a growing business.

Complexity of payroll regulations

As your business grows, so does the complexity of complying with payroll regulations. Manual payroll processing can expose your business to compliance risks which can lead to expensive legal penalties.

It’s vital for your business to stay up to date on changes in tax laws and payroll regulations to avoid compliance mishaps. This is where a payroll system can assist.

By incorporating up-to-date requirements from various regulatory bodies, a payroll system ensures compliance and helps your business avoid legal pitfalls. What’s more, up-to-date payroll software enables your business to stay informed about legislation and tax code changes, facilitating adherence to new payroll regulations.

Frequency of payroll errors

Errors in payroll can lead to significant problems, including employee dissatisfaction and potential legal issues. By automating data entry and calculations, payroll software can drastically reduce the potential for human errors. By establishing multi-level approval workflows in payroll management, timesheets can be validated, and errors prevented before processing payroll.

By simply implementing a payroll software, you can reduce the risks and the worry you’ve had concerning compliance.

The impact of payroll challenges on small businesses

Payroll challenges can put a significant strain on small businesses. Companies with employees often operate with fewer cash buffer days due to the size and volatility of payroll expenses, leading to stress on their limited cash reserves.

However, a properly set-up payroll system can assist small businesses by handling tasks such as recording employee details, calculating pay and deductions, and reporting payroll information to tax authorities, thereby improving operational efficiency.

Let’s delve deeper into how payroll challenges can impact your business in terms of time consumption and financial implications.

Time consumption and productivity loss

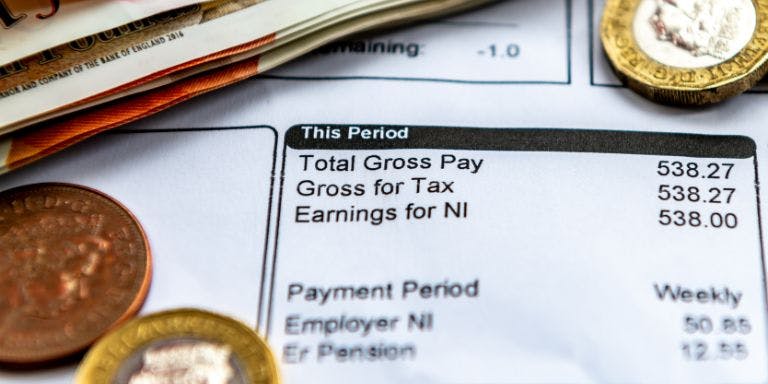

Time is a valuable resource, especially for small businesses. To process payroll manually can be a significant drain on your time as it involves meticulous tasks such as:

Calculating wages

Tax withholdings

Benefits deductions

Payslip production

Distribution

These inefficient processes can incur costs beyond staff wages, due to missed opportunities for business development and optimisation.

Additionally, manually tracking hours worked and paid time off is essential for accurate payroll processing, with variations each pay period requiring careful attention. This time could be better spent on strategic tasks that directly contribute to your business’s growth.

Financial implications of payroll mistakes

Payroll mistakes can be costly. Manual payroll processing increases the risk of calculation errors, which can lead to overpayment, incorrect overtime calculations, and potential penalties and fines for the business.

Automated payroll systems, on the other hand, reduce the time required for payroll processing and minimise the human errors that can result in financial losses. Plus, it can help ensure the accuracy of tax withholdings and reconciliations with payroll records.

Payroll mistakes can result in costly fines and penalties, and these financial blunders can have significant repercussions for a company’s bottom line.

Implementing a payroll solution that accounts for changing regulations and compliance requirements can prevent financial penalties and save costs, emphasising why small businesses should consider a payroll management software.

Discover payroll software for small businesses with BrightHR

As your small business grows, dealing with payroll gets trickier. You find yourself spending more time on payroll tasks, putting yourself at risk of making more errors, and struggling with complex calculations and regulations.

At BrightHR we know how much time payroll tasks can consume and the headaches this can create for you, as a small business owner.

That’s why BrightHR payroll software and support services have been designed—to support small businesses like yours. Taking on the heavy lifting so you can gain back the valuable time required to focus on growing your business.

If you’re feeling the pressure of handling payroll manually, don’t panic, a free demo of our online payroll software is just a click away. Book your free demo today to discover the benefits of a payroll software for your small business.

Looking for an integrated solution? Look no further, BrightHR provides an integrated HR and payroll software solution that hits two targets with one arrow. Providing one simple system for all your essential HR and payroll tasks.