First published on Thursday, April 3, 2025

Last updated on Thursday, April 3, 2025

Jump to section

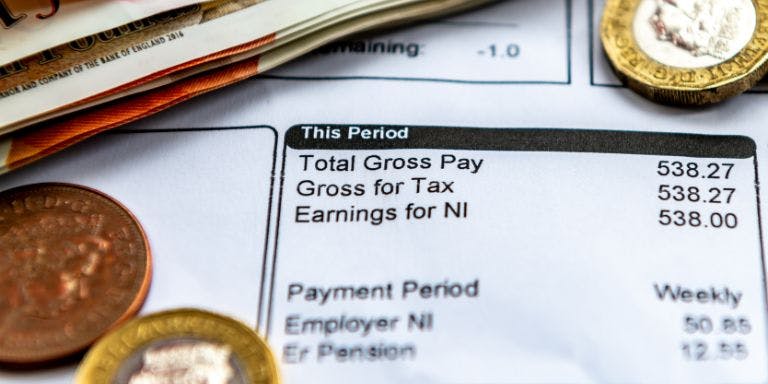

Payslips provide useful information about pay.

For your employees, they are ideal for checking that they have been paid correctly, either according to their salary or the hours worked. But they give some insight into other elements of their pay too.

As an employer, payslips are an essential element of your payroll process and not only is it your responsibility to ensure they are distributed to staff, but it is one of your legal requirements.

In this article we explore the importance of payslips, what UK employment law says about your role, as an employer, and how payroll software can streamline the creation and distribution of your staff payslips.

Workers’ rights to receive a payslip

In the UK you are legally responsible for providing your employees with a payslip, as stated under the Employment Rights Act 1996.

The frequency of which will depend on how often a payday falls.

Payslips are required to detail aspects of an employee's pay, as well as deductions to their pay and other important information such as their name, address, and national insurance number.

Updates to legislation

When the law was updated in 2019, employers in the UK were given a few more legal requirements.

One being to ensure that all workers are provided with a payslip. This includes anyone who has been contracted or arranged to do work or provide services personally for a reward (such as payment of a monetary value or benefit of kind). A comprehensive list of who is legally defined as a ‘worker’ can be found on the government website.

However, there are some exceptions to this rule.

The following type of workers are not entitled to a payslip under UK employment law, though they may still receive one:

Someone who is not defined as an employee or ‘worker’

A person in the police force

A merchant seaman

A master or crew member working in share fishing

The update also requires employers to detail the hours worked by a worker when their pay varies. For example, where overtime has been worked, and overtime pay has been paid.

Information a payslip must include

Payslips must provide your staff with proof of their earnings as well as any tax they have paid and deductions made, such as pension contributions.

You can choose how you wish to supply their payslips, though most businesses now opt for an electronic copy.

The best way to distribute your payslips and what we believe is best practice, is to supply payslips a few days before payday, giving your employees time to raise issues if they spot an error.

Essential details displayed on a payslip include:

Employee's name and address (you may also wish to include their payroll number)

The pay period & date

Gross pay & Net pay

Number of Hours Worked (if applicable)

Rate of Pay

National Insurance Number and employee tax code

Total amount paid and tax paid in the current tax year

The importance of a payslip

For both you and your employees, payslips are incredibly valuable. Below we cover their value for both you and your employees.

For your employees:

As their proof of pay, payslips can be used by employees in a wide range of scenarios. For tax purposes, to calculating pension contributions and even providing a reference when buying or renting a property.

Having been supplied a payslip for each pay period, employees can store a record of these to keep their personal information up to date and to ensure that they have proof of pay throughout the duration of their employment.

Employees are recommended to keep as many payslips as possible to avoid errors with deductions, pension contributions and more.

For whomever and whenever they may need to supply this information, having easy access to their records is essential.

For your business:

For employers on the other hand, payslips are important for making sure your business is:

Legally compliant with employment law and HMRC

Providing a formal record of earnings to all workers

Maintaining efficiency and accuracy of your payroll processes

Ensuring transparency with employees creating a trusting and positive workplace

Storing records of payslips

Employers are not legally required to keep copies of workers’ payslips, however, storing your payroll data is essential for your reporting and for tax purposes.

With your choice of payroll software, you can simplify this process, keeping records of all employee’s payroll data in one secure, online database.

Enforcement of the law

Upon checking a payslip, if an employee notices an error or they believe their payslip is missing information, they have every right to raise a grievance.

If still not resolved after discussions, this could result in taking your business to an employment tribunal.

As a result of the tribunal’s findings, you may be required to make a payment to the employee. The details of which can be found publicly, which could have a huge impact on your business’ reputation.

HM Revenues & Customs (HMRC) are the government organisation who regulate and oversee the payroll of companies in the UK. If you are found to be incorrectly filing your payroll reports, not making accurate payments, or failing to meet certain payroll requirements, you could be fined by HMRC.

Automate the distribution of your payslips with BrightHR

With BrightHR’s online payroll software and support, you can manage your payroll with ease in one simple to navigate system.

Our software allows you to integrate your HR and payroll data, for a seamless approach to people management and pay.

In our centralised software, you can enjoy a faster payroll process, with easy payroll runs, giving your staff immediate access to their electronic payslips on payday. Plus, our system will also support you in staying HMRC compliant, so you don’t have to worry about potential errors or fines.

To explore how our payroll software can make your payroll management easier than ever before, book your free demo today!