First published on Thursday, July 18, 2024

Last updated on Tuesday, August 6, 2024

Jump to section

- Why you need to keep payroll records?

- What payroll records should you keep?

- How long should you keep payslips and payroll records?

- Digital or paper payroll record keeping—What’s best?

- The risks of not keeping payroll records

- How to stay compliant and avoid risks with your payroll document retention

- How BrightHR can help you with payroll record keeping

It might not be the most exciting part of running a business but it’s absolutely essential—payroll records. Yes, we're diving into the nitty-gritty of payslip retention and payroll document management.

Stick around, because getting this right can save you a lot of headaches down the line.

Why you need to keep payroll records?

First things first, why is keeping payroll records so crucial? Well, it’s not just about being organised (though that’s a big part of it). It’s a legal requirement.

The HMRC (Her Majesty’s Revenue and Customs) insists on it, and failing to comply can land you in hot water.

What payroll records should you keep?

So, what exactly should you be hanging on to? Here’s a quick rundown:

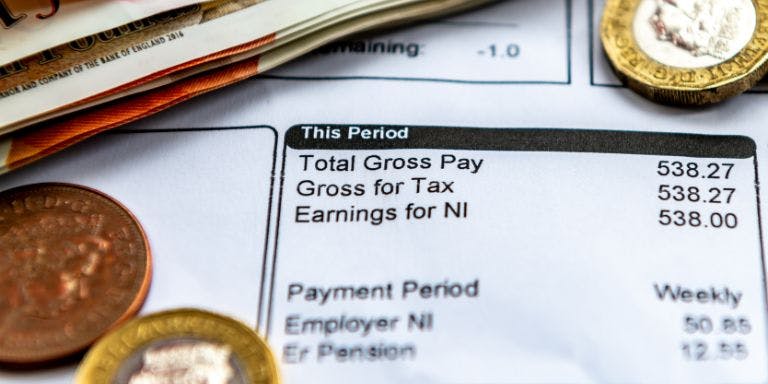

Payslips: Every time you pay your employees, you need to provide them with a payslip that details their earnings and deductions

Payroll reports: These are summaries of your payroll runs, showing who got paid what, and when

Tax records: This includes PAYE (Pay As You Earn), National Insurance, and other deductions

Employee details: Names, addresses, National Insurance numbers, and other key information

Working hours records: Especially important for hourly employees or those on flexible working hours

Pensions: Documentation relating to workplace pensions

How long should you keep payslips and payroll records?

The million-pound question—how long do you need to keep these records? The general rule of thumb is three years from the end of the tax year they relate to. However, some records might need to be kept longer.

These include:

Tax records: Keep these for at least six years. The HMRC can go back this far if they decide to investigate

Employee records: For ex-employees, retain their records for at least six years after they leave. This covers you for any potential claims they might bring up

Digital or paper payroll record keeping—What’s best?

In today’s digital age, you might wonder whether you need to keep paper records or if digital copies will do. Good news—digital records are perfectly acceptable!

Just make sure they’re backed up and secure. There’s nothing worse than losing your entire payroll history because of a computer crash. And having a system that allows for unlimited secure cloud-based document storage can help with that.

The risks of not keeping payroll records

Now that we've covered the basics of payroll record keeping, let's talk about what happens if you don't keep them. Spoiler alert—it’s not good.

Ignoring your payroll responsibilities can lead to some serious consequences. So, let’s break it down.

Penalties and fines

One of the biggest risks of not keeping proper payroll records is the potential for hefty penalties and fines. The HMRC takes this stuff seriously, and if they find out you’ve been negligent, they can hit you with financial penalties.

The penalty HRMC can give you is up to £3,000 and can significantly impact your business’s bottom line.

Legal troubles

Without accurate payroll records, you’re leaving yourself open to legal challenges. Employees might dispute their pay, claim they didn’t receive certain payments, or argue about hours worked.

If you can’t provide accurate records to back up your side of the story, you could find yourself in a tough spot, potentially facing legal action or an employment tribunal.

HMRC investigations

The HMRC has the right to investigate your business if they suspect any irregularities. Without proper records, you’ll have a hard time proving that everything is above board.

These investigations can be time-consuming and stressful, diverting your attention from running your business and potentially uncovering other issues you weren’t even aware of.

Loss of employee trust

Employees trust you to handle their pay correctly and to keep their personal information secure. If they find out you’re not keeping proper records, it can erode that trust.

This can lead to low morale, decreased productivity, and even higher turnover rates as employees seek more reliable employers.

Missed tax deductions

Accurate payroll records aren’t just for compliance; they can also help you maximise your tax deductions.

If you don’t keep track of everything properly, you might miss out on deductions and credits that could save your business money. Over time, these missed opportunities can add up.

Inaccurate financial planning

Without detailed payroll records, it’s challenging to get a clear picture of your business’s financial health. This can make budgeting, forecasting, and financial planning more difficult.

Inaccurate records can lead to poor business decisions, impacting your profitability and growth.

Damage to reputation

In the business world, reputation is everything. If word gets out that you don’t handle payroll properly, it can damage your reputation with both current and potential employees, as well as clients and partners.

A tarnished reputation can be hard to recover from and might impact your ability to attract top talent and business opportunities.

How to stay compliant and avoid risks with your payroll document retention

As mentioned above, the risks of not keeping proper payroll records are very real. It’s not just about avoiding fines and legal trouble; it’s about protecting your business, maintaining trust, and ensuring long-term success.

Taking the time to keep accurate, detailed payroll records might seem tedious, but it’s a small investment that pays off big time in the long run.

If you stay diligent and compliant, your employees and business will thank you for it. And staying compliant is easier than you might think.

Here are some tips:

Schedule regular audit checks to ensure all your payroll records are up-to-date and accurate

Make sure whoever handles your payroll is properly trained and aware of the legal requirements

Use reliable payroll software that keeps you compliant with the latest HMRC regulations

Outsource your payroll to a managed payroll provider, who will take care of everything for you

How BrightHR can help you with payroll record keeping

Keeping your payroll records in order, making sure they're backed up, and staying compliant with legal requirements is essential for your business. While it may not be the most glamorous task, it's crucial.

Fortunately, BrightHR offers online payroll software and support to make this process easier for you. If you prefer, you can also opt for BrightHR's fully managed payroll service for a seamless experience.