First published on Thursday, July 18, 2024

Last updated on Thursday, July 18, 2024

Jump to section

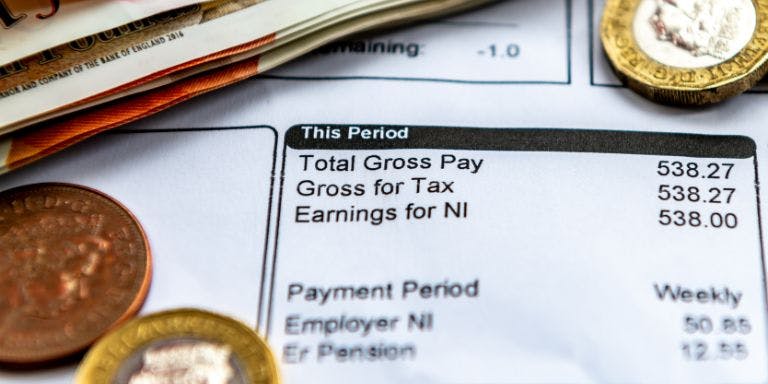

If you’re in charge of your company’s finances, then you’ll understand the challenges of payroll management. From calculating employee work hours to recording employee payment data—everything has to be spot on.

After all, payroll mistakes could hit your business and employees hard. With negative impacts on performance and company commitment. And that’s not to mention the potential for legal penalties.

Read on as we highlight what’s involved in the payroll process and why you might be best off with payroll outsourcing services.

Challenges of In-house Payroll Management

Payroll has traditionally been managed manually and in-house. Depending on the size of the business, this may involve the business owner or admin staff calculating the payroll and directly submitting any deposits.

Unfortunately, internal payroll management is time-consuming and fraught with risk. Each payroll must be meticulously organised and stored for future access. It’s all too easy to make the kinds of mistakes that will have employees thinking twice about their company loyalty. And your expertise could be better applied to other areas of the business.

Other challenges of internal payroll management include:

Monitoring and ensuring compliance with regularly updated tax laws

Secure management of sensitive employee data and safeguarding against cyberattacks

Data entry mistakes, potentially leading to overpayments and underpayments

Costs of maintaining and updating payroll management systems

Increased payroll complexity as the business grows

Considering Outsourced Payroll Services

Of course, there’s an in-house alternative to the spreadsheets and paper-based documents. You could make an upgrade to the use of dedicated payroll software. However, you’ll still face some of the of the challenges associated with manual payroll processing.

Thankfully, there’s a much easier and less stressful way. You can pass the payroll management responsibilities to an external payroll service provider. This will go a long way to ensuring that employee payments are made on time, every time.

And speaking of time, it will allow you more freedom to focus on what you do best, without concern over employee data breaches or payment inaccuracies.

You can get a more detailed explanation of what managed payroll is here.

Assured compliance

Payroll outsource services will assure you of financial management in line with tax laws, regulations, and reporting requirements. Adjustments can be made according to national and local laws on suitable types of compensation, payment schedules and payroll deductions.

You’ll be able to rest easy, confident that you won’t be hit with hefty legal fines and penalties.

A cost-effective choice

While in-house payroll might seem cheaper initially, the long-term costs can add up, especially if you incur the wrath of the HMRC. And payroll outsource services are bound to be a cheaper option than the creation of a dedicated in-house department.

This is particularly true, given the expense of recruiting, onboarding, and training specialist finance staff in a place with high costs of living.

Besides the costs of staff management, you’ll also have to foot the bill for the updating of technology to stay in line with changing tax laws. However, such technology costs will be factored into the pricing of an outsourced payroll service provider.

You might even enjoy the benefit of access to an all-in-one platform, with HR and payroll functions rolled into one.

Tailored business support

An internal team might struggle to keep up as your business grows, leading to delays and errors. However, an outsourced provider will scale with your business, freeing up your valuable time and resources for core activities and strategic initiatives.

Outsourced payroll services also ensure GDPR compliance and robust protection against data risks. Their focus on payroll reduces the risk of costly mistakes, enhancing employee satisfaction and retention, which ultimately benefits your bottom line.

See for yourself that a payroll service is worth it

From time savings to complete payment accuracy, you can enjoy the full range of benefits with the outsourced payroll services offered by BrightHR.

Syncing with your HR and employee data, our all-in-one software allows for an efficient and simplified payroll process. And we offer support from CIPP-qualified UK-based payroll specialists.

See the difference that BrightHR can make:

Automated scheduling of full and on-time employee payments

Easy management of pay-run exceptions and adjustments

Updates in line with the latest payment legislation

Reduced risk of legal penalties and fines.

From payroll calculations to direct conversations with HMRC, we can save you from the payroll woes. And it’s super simple to set up.

Register your interest in BrightHR Payroll for pre-launch updates and special offers!