First published on Thursday, August 1, 2024

Last updated on Thursday, August 1, 2024

Jump to section

Your employees are your most vital asset and as a business, you, of course, want to value and respect your staff. How can you show this? By paying them quickly, efficiently but also accurately. If you are wondering how to pay an employee, we’ve got you covered.

Navigating the intricacies of employee payments is not only a legal obligation for businesses but also crucial if you want to cultivate a motivated and satisfied workforce.

Yes, it’s important to keep morale high but paying your employees correctly means that you are compliant and can avoid any costly fines that result in being on the wrong side of the law.

But what is the best way to pay employees? Read on to discover the many ways that you can pay employees and how you can evolve by using advanced payment technologies.

Understanding the legal requirements for paying employees

There are several legal requirements that you have to adhere to as a UK employer. These requirements ensure compliance with employment law.

The key legal obligations are:

Minimum wage compliance

This means you have to pay employees the National Minimum Wage or National Living Wage—depending on the age of your employees. The rates change annually so it is important to stay up to date.

Pay frequency

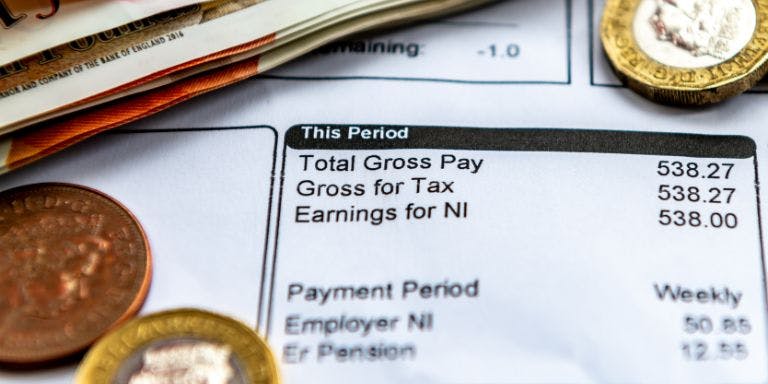

You must specify the frequency of pay. This could be weekly, bi-weekly or monthly. This information should be stated in an employee’s contract and the wage should be received according to the agreed schedule.

Tax and National Insurance

It’s your responsibility as an employer to calculate the correct amount of Income Tax and National Insurance. You must also deduct these from employee wages.

Pension auto-enrolment

You must enrol eligible employees into a workplace pension scheme. Employees can opt-out, but they must be made aware of their options.

This is very complex and there are lots of legal requirements to factor in for each and every employee.

Failure to comply can result in legal penalties. This is why having access to expert legal advice is beneficial when maintaining ethical business practices.

Exploring payment options

When it comes to paying employees, you have various methods available to you. There are traditional methods such as cash payments and bank transfers or modern methods such as digital wallets and electronic fund transfers. But which are the best ways of paying employees?

Both traditional and modern methods come with their set of advantages and drawbacks, and every business will have a personal preference.

While traditional methods can be convenient, such as cash payments having no transaction fees, there is a security risk with cash payments, and it can be challenging to maintain accurate records.

Digital wallets and EFTs give employees instant access to their funds and have enhanced security measures in place and ensure you are compliant with banking standards.

Embracing digital payroll systems to help pay employees

More and more businesses are leveraging digital payroll systems to streamline their payroll processes and enhance efficiency.

Advantages of digital payroll services include:

Saving time: Digital payroll systems automate compliance-related tasks, including employee payments, saving time and allowing you to meet deadlines easily.

Accuracy and reduced errors: Automated calculations minimise the risk of human error. Manual payroll processing can result in miscalculations of hours worked or incorrect tax withholdings.

Real-time updates: Changes can be made in real-time ensuring records are always accurate and up to date.

Enhanced security: Digital payroll solutions employ encryption and security protocols that you wouldn't otherwise have access to.

Compliance: Digital payroll services are designed to stay current with changing tax laws and compliance requirements.

Cost savings: Digital payroll services can help businesses save on administrative costs and training costs. They can also lower the administrative burden on inhouse resources.

These are just a few of the advantages that come with using digital payroll systems like BrightHR. When you choose a digital payroll service, you have access to quick resolutions to any payroll problems with an expert on hand at all times to assist you.

The importance of communication and transparency when paying employees

Communication and transparency are critical factors when creating an effective and efficient payroll strategy. Being open and honest about employee payment processes builds a sense of trust between employers and employees.

When the communication regarding pay is clear, employees feel more involved in the process and feel more respected and valued. Clear expectations can motivate employees and transparent communication regarding pay criteria, pay slips and wage deductions can cultivate a positive working environment.

This is also important as it helps ensure you comply with legal requirements. By prioritising open dialogue, you can expect a more harmonious workplace.

Get help paying your employees with BrightHR

Ensuring timely and accurate payments is fundamental to fostering employee engagement and satisfaction—not to mention a legal requirement. However, while it can be challenging to navigate the complexities of payroll, embracing modern payment technologies can offer you a significant advantage.

Are you ready to take the stress out of your payroll processes? BrightHR Payroll Software and support services can ensure that you have all of the tools and resources you need to simplify payroll processes.

Check out our payroll software and support services today and make paying employees a breeze.