First published on Wednesday, July 31, 2024

Last updated on Wednesday, July 31, 2024

Jump to section

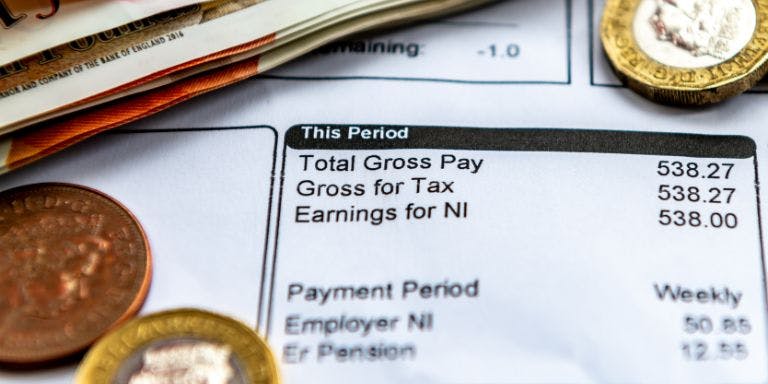

Managing payroll is a critical task for businesses in the UK, but it's easy to slip up. Mistakes can lead to financial headaches and legal trouble.

Fortunately, payroll software can help smooth things over. Let’s dive into the common payroll errors and how using payroll software can help you dodge them.

Incorrect employee information

Mistakes in employee information, such as incorrect names, National Insurance numbers, or bank details, can cause payment delays and compliance issues.

Payroll software keeps all your employee data in one place and runs checks to catch mistakes. It makes sure you’ve filled in everything correctly and flags any errors. Plus, regular updates mean any changes to employee info are sorted quickly.

Misclassifying employees

Getting the classification wrong—confusing employees with contractors or the other way around—can mess up tax filings and land you with fines.

Payroll software helps you set up different categories for employees and contractors with the right tax rules for each. It alerts you to any issues, ensuring taxes and benefits are applied correctly according to their status.

Not following HMRC rules

In the UK you must follow HMRC regulations for tax filings, National Insurance contributions, and reporting. Slip-ups here can mean penalties.

Good payroll software links directly with HMRC, making sure all your tax codes are up to date. It automatically prepares and submits filings, keeping you compliant and cutting down on human error.

Wrong tax withholdings

Mistakes in tax calculations can lead to underpaying or overpaying taxes, which might result in fines and unhappy employees.

Payroll software uses the latest tax rates and rules to calculate withholdings automatically. It handles complex tax scenarios and ensures calculations are spot-on. Regular updates keep everything aligned with current tax laws.

Inaccurate time tracking

Errors in tracking hours, overtime, and leave can mess up payroll and lead to disputes.

Many payroll systems inclue time tracking or can sync with external tools. This ensures all logged hours are accurately reflected in payroll calculations, reducing errors and making sure employees are paid correctly for their time.

Missing pension contributions

Not calculating and managing pension contributions properly can lead to non-compliance with auto-enrolment regulations and upset employees.

Payroll software automates pension contributions and ensures compliance with auto-enrolment rules. It tracks contributions, generates reports, and handles communication with pension providers, making sure everything is managed correctly.

Late payments

Delays in processing payroll can lead to late payments, which can really hurt employee morale and trust.

With payroll software, you can schedule payments in advance and automate the payroll process. Reminders and workflows ensure payroll tasks are completed on time, every pay period.

Avoid common payroll errors with BrightHR Payroll

Switching to payroll software is a smart move if you’re looking to improve your payroll accuracy and compliance. By automating complex tasks, staying up-to-date with HMRC regulations, and cutting down on human error, payroll software can turn payroll from a potential problem into a smooth, efficient process.

Investing in good payroll software not only prevents common mistakes but also keeps your team happy and productive. So why not start your journey to no more payroll errors today? Check out our payroll software and services.