First published on Tuesday, April 1, 2025

Last updated on Tuesday, April 1, 2025

Jump to section

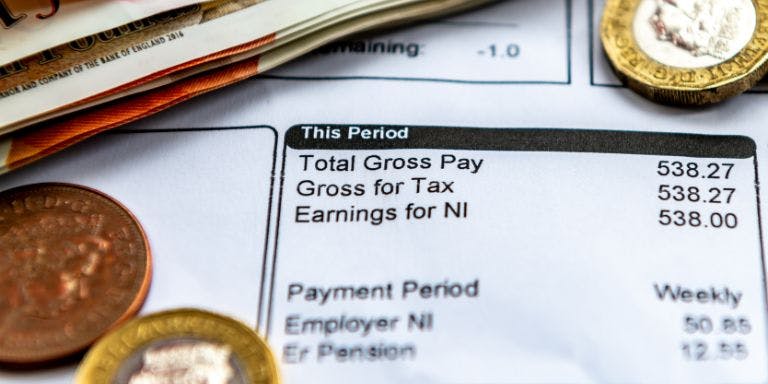

Payroll processes are essential for the running of any business, no matter how big or small. These processes include making payroll runs, distributing payslips, and keeping up to date with HMRC payments. Which, in turn, requires the use of sensitive data and private employee information.

When it comes to keeping data safe and secure, never has it been more important to consider the risks associated with online payroll. With a world of cyber threats and online security concerns, the risks are now greater than ever.

This is why we have written a guide, to help you understand how to keep your payroll data secure and to stay GDPR compliant. Plus, discover how a secure online payroll software may be the right solution for protecting your data.

Is your payroll data secure?

First things first, it’s a good idea to identify risks and whether your payroll processes, as they currently exist, are vulnerable to data breaches.

Ask yourself:

Do you know how secure your payroll data is?

What processes are in place to protect sensitive employee information?

Is there a protocol to follow if a data breach does occur?

Does your current payroll system provide adequate security features?

If you don’t know the answer to one or any of these questions, the answer is likely that your data is not as secure as you may you think.

The sensitive nature of payroll information

Your payroll data, including employee names, bank details, addresses and more contains both personal and financial information. Tied to the payments of monetary value, this of course, makes it a target for cybercriminals.

As an employer you are responsible for ensuring this information is protected and does not fall into the wrong hands.

The impact of GDPR laws on payroll processes

General Data Protection Regulations or better known as GDPR in the UK, alongside the Data Protection Act 2018, govern how personal data is used and handled. Protecting individuals from the unauthorised access or unlawful use of their personal data.

Since your payroll process use a large amount of personal data, UK GDPR and data protection laws apply. They outline a framework in which businesses must adhere to when dealing with personal data of any kind.

Anyone handling personal data needs to ensure that the information is:

Used in a fair, legal, and transparent manner

Utilised for clear and specific purposes

Managed in a way that is suitable, relevant, and limited to what’s essential

Accurate and updated when needed

Retained only for as long as necessary

Protected with adequate security measures to guard against illegal or unauthorised processing, access, loss, destruction, or damage

More on your responsibilities under GDPR and the Data Protection Act 2018 can be found on GOV.UK.

The risks of payroll data breaches

Your first concern should always be the protection and security of your employee’s personal information. From their bank details to their personal information.

However, if your business experiences a payroll data breach, it can have serious repercussions for you and your company.

Financial impact

A breach can result in major financial setbacks for both an employer and employees, including issues like fraud, identity theft, and potential legal fines. To reduce the risk of having to potentially pay hefty fines, compensation to your employees, and even losing financial assets to cybercriminals, keeping payroll data secure is essential.

Damage to reputation

If an incident does occur the potential backlash your company may experience would have a huge impact on your reputation. In the digital age, running a business that becomes known for a lack of data security could severely affect your public image. Generating a negative response from both employees and even your customers/clients.

Legal issues

If a data breach occurs because of a failure to adhere to current GDPR and data protection laws, you could find yourself in legal trouble.

Not only can The Information Commissioner’s Office (ICO) act against you. Which may include sanctions and even a suspension of your data processing, individual employees who have subsequently fallen victim to a breach of personal data can claim compensation and take legal action against your business for damages.

Penalties for not safeguarding employee data can exceed six figures. Therefore, having a huge financial impact on your business.

Employee anxiety

With your employees at the centre of a payroll data breach, the effect this can have on employee wellbeing and their loyalty to your business may certainly falter.

Employees may feel anxious about their employment with your business. detrimentally affecting your company’s recruitment efforts, workplace culture, and staff retention rates.

Real-world examples

Don’t think it could happen to you? Think again, data breaches and hacks are more common than you may think and even happen to some of the nation’s most secure organisations.

As recently as May 2024, the Ministry of Defence fell victim to a data breach. Exposing the personal information of UK military personnel. Including bank details, salary information and more.

Other companies such as the BBC and British Airways have experienced the nightmare of payroll data breaches. Emphasising just how important it is to take payroll data security seriously.

Storing payroll records

To protect your data, you must only store records for as long as is required. This is particularly important when employees leave the business. In our article ‘payroll record keeping’ we have provided more detail on this topic. Diving into how to store your payroll records and how long you should keep records when an employee departs from employment.

Discover payroll software to secure your data with BrightHR

Security lies at the very heart of the products we provide at BrightHR. With a dedicated information and cyber security team we have complete oversight of your data protection. Restricting and granting access to only those employees who require it.

What’s more, across all our teams we are committed to GDPR compliance. As part of our role as a data processor we always store data local to the company that are using it and use encryption to protect it.

What’s more, our payroll software is accessed using a multi-factor authentication process. Adding an extra layer of security to keep your payroll data safe and secure.

To discover how payroll software can enhance your payroll processes but also how BrightHR’s payroll software and dedicated team endeavour to keep your data secure, book a free demo today.