First published on Thursday, May 30, 2024

Last updated on Friday, March 7, 2025

Jump to section

Payroll is a significant element of your people management and HR processes. Ensuring your employees are paid on time and your records are compliant with HMRC.

But the term payroll is a rather large umbrella term that encompasses a wide range of practices and processes.

In this guide we help to generate some clarity for business owners and managers unsure about payroll and what it means. Plus, provde an overview of payroll software and its benefits for businesses.

The definition of payroll

Essentially, payroll is calculating and distributing your employees’ earnings, balanced with tax withholding, benefits, and compliance with government regulations.

Yet, payroll is more than a simple act of payment. It's a complex process that makes sure employees get paid while following all the legal rules.

It involves:

Deducting taxes

Contributing to National Insurance

Reporting to HM Revenue and Customs (HMRC)

Issuing payslips

Making sure that employees are paid on time

Maintaining staff records

And as a business owner, you are legally responsible for making accurate payroll calculations. Payroll is also essential for keeping employees happy and satisfied, helping you to retain your top talent and improve the culture of your workplace.

The basics of payroll processing

When you dive into the depths of payroll, you’ll quickly realise that payroll is a dynamic process.

The heart of payroll lies in the recording of employee information, salary details, and benefit contributions.

But it’s not just about keeping records; you must perform calculations, considering varying pay rates and additional payments, and deductions to generate accurate payslips for your workforce.

To help explain these processes, below we highlight the core components of payroll processing:

Storing employee information

Having the correct information about each one of your employees makes all the difference when it comes to getting your payroll processes right.

The foundation or efficient payroll, storing up to date records of employee information will ensure that payslips are sent out on time and employees are paid accurately.

This means gathering the following employee information:

Names

Addresses

National insurance numbers

Salary details

All of these are essential for running payroll. Which is why keeping employee records up to date in a secure but easy to access location is so important. With BrightHR’s unlimited document storage, you can store all your relevant HR and payroll records in one easy to access place. Based in a secure, digital storage file, you can ensure that both you and your employee can easily reach these documents when you need them.

Calculating gross and net pay

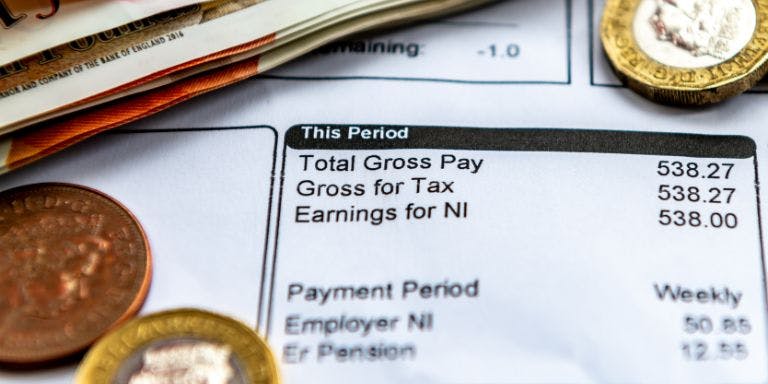

Gross and net pay are two essential features of an employee’s payslip. Therefore, calculating these and getting them right is vital. Afterall, your employees will be checking.

Gross pay- Is the actual amount of money the employee has earned according to the hours or days.

Net pay (frequently referred to as ‘take home pay’) – It is the amount that the employee will receive once all deductions have been paid.

It's important to note that clearly showing the difference between gross and net pay on payslips is not only useful but also a legal requirement.

For clear directions on how to calculate both gross pay and net pay, read our article on calculating payroll.

Handling taxes and deductions

As the old saying goes “In this world nothing can be said to be certain, except death and taxes.” Which means there’s no running away from this essential aspect of payroll.

As an employer you are responsible for calculating tax deductions as well as any other voluntary deductions such as pension or private healthcare contributions.

By getting these calculations right, you will be able to ensure that both your employee and the government receive their correct shares. To do this, you must follow HMRC’s rules, including using tax codes, to calculate and withhold the correct amount of income tax and National Insurance contributions, ensuring compliance with payroll legislation.

Other deductions such as voluntary deductions including pension commitments and student loan repayments vary with each employee’s circumstances.

Employers also contribute to pension schemes, accounting for at least 3% towards the total minimum contribution—a vital part of the UK’s payroll legislation.

Even holiday pay has its place in the payroll ledger, taxable as earnings unless received early.

Navigating payroll requires up-to-date tools and a keen eye on payroll legislation to stay compliant. The cost of getting it wrong can lead to hefty penalties, daunting investigations, or worse, prosecution.

Payroll reporting and compliance

Much like many other HR process, payroll has its regulations. HMRC are the government body that regulates payroll in the UK. Setting out rules and regulations that must be adhered to by all businesses. Their rules cover all the essentials including paying your employees on time, completing accurate payroll calculations, and keeping updated documents of employee information.

As such, certain payroll information must be reported to HMRC. The following is a guide to help you get started:

Register as an employer

To start you need to register as an employer with HMRC which will provide you with your PAYE reference number. This is essential for deducting taxes from employee payslips.

Complete a registration form with your company and employee details to set up PAYE.

Make accurate calculations and deductions

Next, establish a payroll scheme to accurately calculate salaries and deductions.

You are responsible for calculating gross wages, deducting the correct tax and National Insurance, and determining net pay, ensuring compliance with HMRC's tax bands and thresholds.

Provide HMRC with payroll data regularly

Regularly submit payroll data to HMRC, typically monthly, through their online portal. You may also need to file additional reports, like the Employer Payment Summary (EPS), for claiming reductions.

Keep employee records up to date

Finally, maintain accurate payroll records securely for potential HMRC audits or inquiries.

Streamlining payroll with payroll software

In order to run payroll yourself, it is important to streamline these processes with the support of payroll software.

BrightHR’s online payroll software will help you with important payroll tasks such as:

Tax and voluntary deductions

Calculating gross and net pay

Automatically calculating employee pay rates

Provide staff automated payslips

Streamline your payroll reporting

Generate FPS and EPS files to send to HMRC

To see how BrightHR can support your payroll processes, book a free demo of our payroll software today.

Or find out more about our managed payroll services. Taking the stress of your shoulders, knowing your payroll is in the safe hands of our CIPP qualified team.