First published on Thursday, August 15, 2024

Last updated on Thursday, August 15, 2024

Jump to section

To keep your business in line with the law, there are certain employment documents that you need to hold on to. And having an HR document storage system can help you keep your records in order, ensuring that you always have what you need to comply with the law and any audit needs.

But what are the employee records that need to be kept and how long do you have to keep them?

Let’s break down how long you need to hang onto different types of employee records for various employees. Just remember once you know the retention periods, you need to set them out in a privacy notice for your business.

How long to keep employee records for your current staff?

For your current employees, both full-time and part-time, you need to keep a variety of records to ensure you're compliant with UK laws and regulations. This includes sticking to data protection principles, assuring that data is not retained longer than necessary for processing purposes.

Here’s what you need to know:

General Employee Records

Personal details: Names, addresses, birth dates, and contact information

Employment contracts: Terms and conditions of employment, including any updates

Payroll records: Details about wages, overtime, bonuses, and deductions

Working time records: Hours worked, rest breaks, and holidays

How long to keep them? Generally, keep these for 7 years after employment ends. This helps you comply with HMRC requirements and any potential audit needs.

PAYE Records

When it comes to PAYE (Pay As You Earn), there’s a bit more precision involved. These include:

Payslips: Copies of what you give to employees

P60s and P45: End-of-year certificates and forms for leavers

Payroll tax calculations: How you've worked out the employee's tax and National Insurance

What’s the retention period for these? Keep these for 3 years after the end of the tax year they relate to. However, it’s worth holding on to these for 7 years in case a dispute against you is raised. This is also crucial for HMRC inspections.

Statutory Sick Pay (SSP) Records

If you have employees who have taken sick leave and received SSP, you’ll need to retain:

Dates of sickness: When the employee was off sick

SSP payments: Amounts paid, and the dates paid

How long to keep them? Keep these records for 3 years after the end of the tax year they relate to. Again, it’s best practice to keep these for 7 years if a dispute arises.

Maternity, Paternity, Adoption, and Shared Parental Leave

These records are slightly different. You need to document:

Leave dates: When the leave was taken.

Payments made: Statutory Maternity Pay (SMP), Statutory Paternity Pay (SPP), etc.

The retention period for these? Hold onto these for 4 years after the end of the tax year in which the leave period ends.

Health & Safety Records

For records related to workplace health and safety, such as accident reports and records of incidents involving hazardous substances:

Accident books: Details of any work-related injuries

Risk assessments: Evaluations of potential workplace hazards

How long to keep them? These should be kept for at least 3 years after the date of the last entry. For certain incidents involving hazardous substances, you may need to keep them for up to 40 years.

Records of Dismissals and Redundancies

If you’ve had to dismiss employees or make redundancies, you should keep:

Dismissal and redundancy records: Documentation related to the decision-making process and final actions

The retention period? These should be kept for 7 years after the employment ends. This is particularly important if there are any claims of unfair dismissal or redundancy pay disputes.

Additional records you should keep

Right to Work checks: Keep copies of proof of eligibility to work in the UK for 3 years after employment ends

Disciplinary and grievance records: Retain these for 7 years after employment ends

How long should you keep records for ex-staff?

When an employee leaves your business, you still need to keep certain records for a specified period. In fact, you should really keep all employee records after employment ends. The list of documents you need to keep is extensive, see types of HR documents UK business owners need to keep for a full list.

Here’s a few records you need to maintain for your ex-staff:

General employee records

Records of dismissals and redundancies

Disciplinary and grievance records

These should all be kept for 7 years from the end of their employment. This covers you for any future disputes or claims.

How long should you keep records for contractors and freelancers?

Contractors and freelancers are a bit different from regular employees, but you still need to keep some records to stay compliant and organised, if you employ them to do work for you. Here’s what to consider:

Contracts and Agreements

You should keep the terms and conditions of the contract, including payment details for 6 years after the contract ends. This helps in case of any disputes over contract terms or payments.

Payment Records

Details of payments made to contractors or freelancers including invoices and payment records should also be kept for 7 years from the end of the last tax year they relate to. This ensures compliance with HMRC requirements.

Health & Safety Records

If any of the contractors or freelancers you hire are involved in any health and safety incidents, you need to maintain records of these. As with regular employees, keep these for at least 3 years after the date of the last entry.

Why keep these records?

Keeping accurate and up-to-date records isn't just about compliance. It’s also about protecting your business. These records can help you better manage your workforce, handle disputes, and meet legal obligations.

So, get your filing system in order and make sure you’re ticking all the boxes. Your future self will thank you.

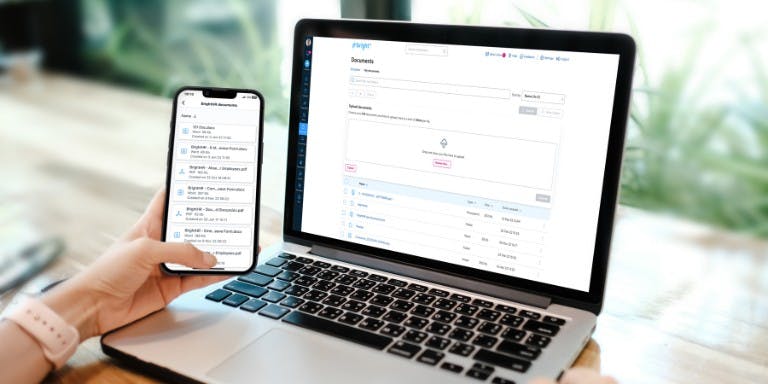

Get a secure cloud-based document storage system

It’s all good knowing what employee records you need to keep and how long for but if you don’t have a secure place to store them. It can be hard to find what you need when HRMC or an employee dispute comes knocking.

That’s where BrightHR’s secure online document storage comes in— it’s also unlimited. With our HR document storage, you can:

Stay on top of important updates with instant alerts and read receipts

Access vital documents at your convenience, wherever you are

Ensure the security of your confidential information

Save time by uploading HR documents in bulk to our secure system

Generate reports to swiftly check which team members have reviewed and accepted important documents

Fulfil your legal record-keeping requirements by preserving an archive of all documents

But that’s not all. To see how our document storage alongside our HR software can help your business, book a free demo today!