First published on Tuesday, March 18, 2025

Last updated on Tuesday, March 18, 2025

For small business owners, we understand that payroll can be a headache. Without the support of payroll experts, it can be difficult to juggle payroll processes whilst keeping on top of your other duties.

But it doesn’t have to be this way.

There are solutions to manage the pain of payroll. Giving you time back for other important tasks.

Let’s delve into the details of managed payroll services for small businesses to uncover the secrets behind managing payroll without a hiccup.

The challenge of handling payroll and end of financial year reporting

When you manage a business with only limited time and a small team, payroll is a task that will consume a lot of time and effort. Requiring an understanding of payroll processes, taxes, and HMRC requirements, it can quickly become a job that causes you problems.

Add the end of financial year deadlines into the mix and you’ve quickly got an overflowing to-do list.

From payday delays to payroll errors that lead to incorrect employee payments and tax filings, your business could even find itself in hot water with the so-called “taxman” i.e. HMRC.

As a solution, more and more small business owners opt to outsource their payroll to a professional team, capable of handling everything from employee pay, tax filings, and distributing P60s.

5 reasons you should choose a managed payroll service

Outsourcing to a team of payroll experts who have experience in dealing with a range of payroll processes and challenges, means you can relax knowing your payroll is in the safe hands of a qualified team.

A managed payroll team can do all this and more for you:

Accurately calculate and disburse employee pay

Distribute payslips via email or electronic system

Complete timely tax deductions and filings

Ensure HMRC compliance and complete reporting

Keep employee payroll data up to date

1 – Reduce the risk of payroll errors

With experts on your side the chances of anything going wrong are greatly reduced. Helping you avoid potential penalties, hefty fines, and grievances raised by employees.

2 – Stay compliant with HMRC

Rather than having to get to grips with the law yourself. CIPP trained professionals already have this covered. They will make sure your payroll is HMRC compliant, so you stay on the right side of the law.

3 – A scalable solution for your growing business

As your business grows so too does your payroll processes. Managed payroll service providers are experts in dealing with a range of payroll systems for businesses of all sizes. Meaning these services can expand as your business grows.

4 – Expert knowledge and support

As well as having a payroll manager who can complete your payroll processes, you’ll also benefit from the ongoing support of a team with expert knowledge. Helping you with tasks such as managing starters and leavers on your payroll system, ensuring your payroll reflects current national minimum wage standards and more.

5 – Get back to the day-to-day running of your business

With support from an external provider, you can gain back some of the time typically lost on manual payroll tasks and get back to the important stuff, like growing your business.

Simplify payroll for the new financial year 2025/26

Register your interest for our managed payroll service. Outsource your payroll processes with our CIPP qualified team for a stress-free approach to payroll.

No more sleepless nights and last-minute checks ahead of the new financial year. Allow our team to get your payroll processes under control, in-line with regulations, and up-to-date to meet end of financial year deadlines.

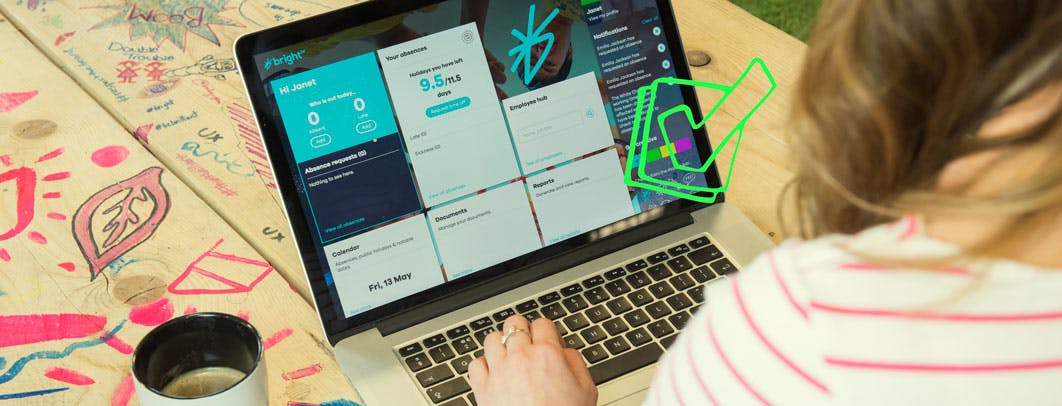

What's more, everything can be handled within our online payroll software. Giving you a 360-degree view of your team's payroll information, data, and reports. Book a free demo today to discover how BrightHR can elevate your payroll processes.